When you compare automobile insurance, you will see car insurance premiums rising and falling in proportion to deductibles. The lower the deductibles, the more expensive the car insurance policy. This is because a lower deductible shifts the financial burden onto the insurer, so they charge a higher rate.

Luckily, car insurance deductibles are customizable.

Car insurance deductibles might be in effect for most types of auto coverage in a policy. It's common to see deductibles in the following coverage categories: comprehensive; collision; personal injury; and, in some states, uninsured motorist property damage. In contrast, liability insurance (harm you cause to a person or property) never has a deductible.

The deductible represents the amount you must pay before the insurance takes over. You're responsible for paying the deductible for every claim, even if you filed a similar claim the same year. Unlike with health insurance deductibles, there is no annual cap on how much you could pay in car insurance deductibles.

Find Cheap InsuranceTip

Increasing a deductible is a popular way to reduce the price of car insurance, but keep in mind how much cash you generally have on hand. You wouldn't want one claim to wipe out your checking account.

You only pay a deductible when your own vehicle sustains damage covered by your policy. If you damage another person's car, your liability coverage kicks in to repair their car, and there is no deductible for liability insurance.

Car Insurance Deductible Example

Most car insurers simply subtract the amount of your deductible from your claim. If an accident results in $2,370 worth of damage to your car and you submit the claim and the receipts accordingly, the insurance company will deduct your collision deductible before reimbursing you. Say your deductible is $600; you'll get reimbursed $1,770 for this claim.

What If the Accident Was Not My Fault?

If the other driver is officially blamed for the accident, his or her insurer may reimburse your deductible if you file. Keep in mind that some drivers are uninsured or underinsured, in which case you would rely on your own policy's protection from such drivers, and many uninsured/underinsured policies do have deductibles.

Sometimes both drivers in a collision are covered by the same insurer. That's what happened to Kendahl Shane: "Long ago, my wife’s car was hit by a red light runner. He and we were insured by the same company. The company waived our deductible." Nonetheless, when you're choosing deductibles on your policy, you should always expect to have to pay them in the event of an accident.

Can I Make the Other Driver Pay My Deductible?

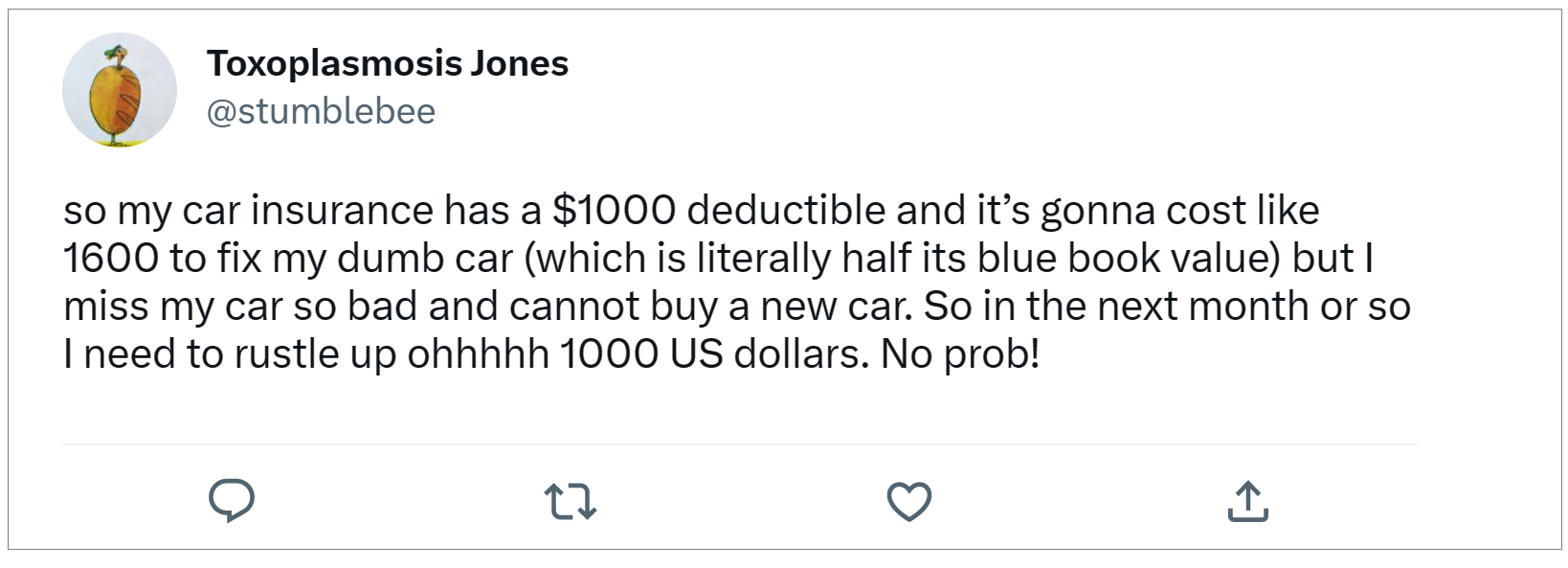

In cases when the insurance companies are unwilling to assign blame (this happens even when there’s a police report), you'll be stuck paying your deductible in order for your insurance to cover the rest of the damages to your vehicle. This vehicle may be your sole mode of transportation, how you get to work, so you probably won't want to delay getting it out of the shop. You'll pay the deductible, and then you can ponder reimbursement.

If you are confident that you can explain why the other driver was at fault, you might sue in small claims court for the reimbursement of the deductible. But will the effort be worth the hassle? "You might be able to get a judgment for the amount, but you have to weigh the time and expense of filing the claim, appearing in court, and then enforcing the judgment against the amount of money that you're going to get back," says law school graduate Cliff G. of Washington.

What If My Car Repairs Cost Less Than My Deductible?

Because the car insurance deductible represents the money you must pay first, before your insurance kicks in, repairs that costs less than your deductible are entirely yours to pay. In these cases, drivers often refrain from reporting the accident to their insurance company, especially if no other drivers were involved (e.g., you hit a tree).

So, if a crater-sized pothole wrecks your car's suspension on the way to work one day and will cost $400 to repair, and your deductible is $500, your insurance policy does not come into play. You are on the hook for the full $400 because it is less than the deductible.

Deductibles are generally around $500 but can go up to $2,000. Some insurers offer "disappearing deductibles," where the deductible gradually goes down so long as you have no incidents for a predetermined length of time.

Beware becoming effectively uninsured.

Carrying too-high deductibles could leave you in a state called "effectively uninsured," when you carry all the legally required insurance for your vehicle but with deductibles so high that you must pay for the most common problems on your own. You have insurance, but you can hardly use it. The effectively uninsured might drive a car with a chipped windshield and a dented door and a smashed fender because each of those repairs would have required paying a high deductible when they happened, which the driver couldn't afford.

Tip

Determine how much savings to keep in an emergency fund by looking at your car insurance policy's highest current deductible as well as the deductible on your medical insurance. Your savings should be larger than those deductibles combined.

Is $2,000 Too High a Deductible?

To keep automobile insurance affordable for more drivers, higher deductibles are becoming available on more policies. Rather than thinking of this as an instant way to save money, consider what you would do if your car needed repairs before you could drive it again, and choose a deductible low enough that you could afford those repairs.

"If you can cover $2,000 out-of-pocket after an accident, then you can go for the lower monthly premium," explains insurance agent Kathy Mobley. "If you don't have $2,000 cash on hand, probably go for a lower deductible and pay a bit more each month. We kind of suck at cash management so we have a $500 deductible."

Imagine your only vehicle is in the shop and you can't get it out without the insurance company's check. The deductible must be paid. When shopping for quality auto insurance, try not to settle on deductibles so high that you wouldn't be able to get your car back without waiting on future paychecks.

How Much Can You Save by Raising Your Car Insurance Deductibles?

The price of covering your vehicle might go down about 30% if you choose higher deductibles. Be warned: High deductibles could mean that one accident might wipe out your emergency savings, leaving you vulnerable until you can build up the savings again.

|

|

||

|---|---|---|

| Deductible | Monthly Premium | Cost Difference |

| $100 | $250 | n/a |

| $250 | $182 | 27% less than $100 deductible |

| $500 | $129 | 29% less than $250 deductible |

| $1,000 | $89 | 31% less than $500 deductible |

| $2,000 | $84 | 6% less than $1,000 deductible |

Conclusion: Car Insurance Deductibles

As car insurance rates continue to climb this year, you might consider moving to higher deductibles to keep your premium affordable. But as tempting as it may be to choose the highest deductibles available (and therefore the lowest premium), doing so puts your wallet at risk in the event of the more common, minor accidents. Sure, the insurance company will be there for you after a major incident, but you'll be out-of-pocket for fender benders, pothole damage, door dents, and the like.

If you're a safe driver with a short commute and you have never (or hardly ever) filed a claim with your car insurance company, and you have cash set aside for emergencies, then a car insurance policy with high deductibles can save you money every month.

Find Cheap Insurance